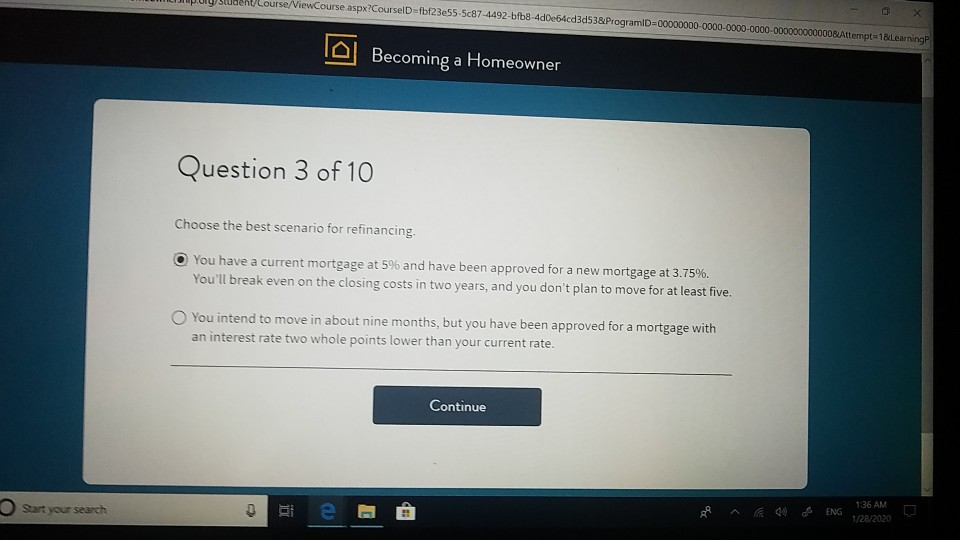

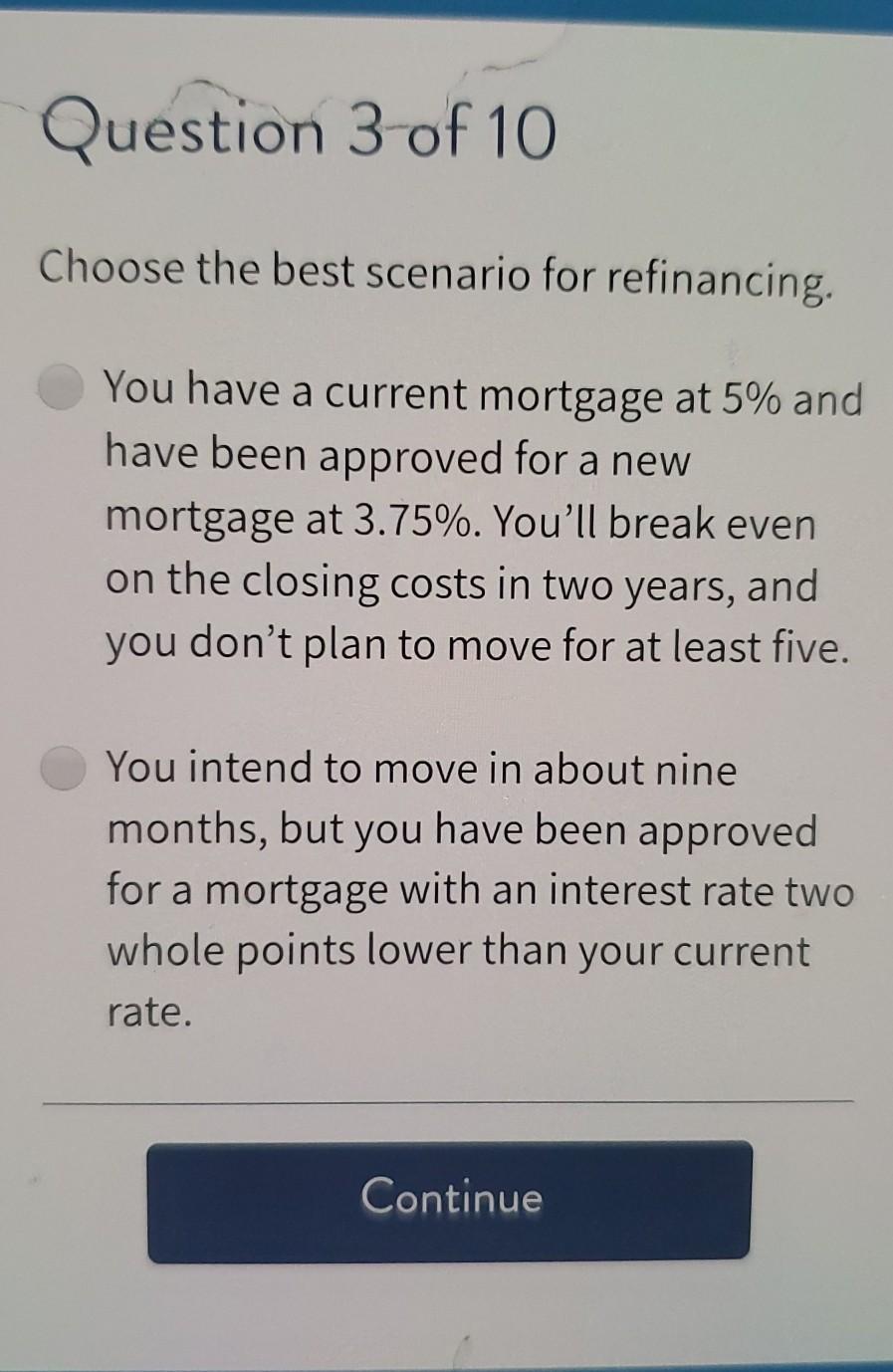

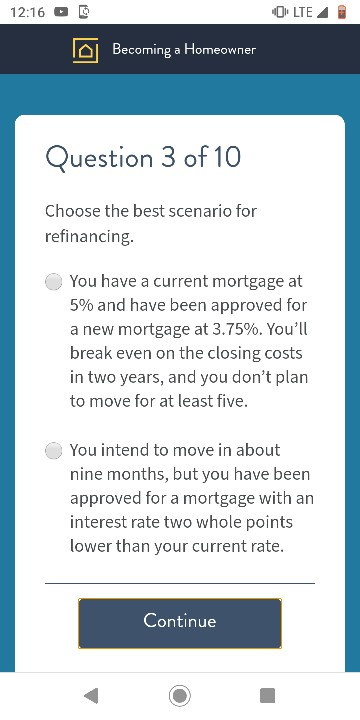

choose the best scenario for refinancing answer

We have a number of business loan options like term loans invoice factoring merchant cash advance and more. In that scenario you could use the average of your monthly spending as a guideline.

Choose The Best Scenario For Refinancing Homeworklib

A recent NFCC and Wells Fargo survey may have your answer.

. Student loan refinancing on the other hand can be done with multiple loans federal or private student loans and it can also be done with one loan. Debt shouldnt happen first. We guarantee a perfect price-quality balance to all students.

When to consider a refinance of your reverse mortgage. I can tell you that there are still zero down mortgage options available in certain situations including for USDA and VA loans and widely available 3 and 35 down options as well. We will guide you on how to place your essay help proofreading and editing your draft fixing the grammar spelling or formatting of your paper easily and cheaply.

You originally obtained your loan when the lending limit was less than the 2022 Home Equity Conversion Mortgage HECM limit of 970800 and your value is at or higher than the HUD limit especially the limit that was in effect at the time you closed your loan. That depends on a lot of factors including the purchase price of the home the type of loan you choose the property type the occupancy type your credit score and so on. Best Customer Support Service.

800am - 400pm AEDT Find a branch. And wants to choose an investment with at least a 12 rate of return. If you pay 6000 in closing costs to save that 50 a month it will take you 120 months or 10 years to break.

Your home value has increased considerably. In fact you can jump in on the debate of save money or pay off debt and learn the right answer for yourself. The 12-month period must have occurred direct ly prior to permanent financing.

How to FAQs. Delancey Street provides small business loans nationwide. The goal with refinancing is to get a rate reduction and it involves getting a new loan with a different ideally lower interest rate.

According to the Bureau of Labor Statistics the average. Get 247 customer support help when you place a homework help service order with us. For two of them you can find debt free success stories.

Get a risk free consultation so you can learn your options today. So lets say refinancing today means saving 50 a month on your monthly payments. Help Support.

Thats a notable drop from 2020 when the average borrower had a balance of 2906. In 2021 the average credit card borrower owed 1847. While the third option is left searching.

How much do you need to put down on a house. There are three common ways to pay off your debt. Enter your details to find out what rates may be available for your scenario.

Speak to one of our friendly staff at a branch near you Connect online. 800am - 800pm AEDT Sat. 12 months The construction period is limited to no greater than 12-months.

How do I choose a mortgage. She could realize a rate of return of up to 11 if she invests in gold bullion or 9 if she invests in a certain mutual funds. Donnas financial advisor tells her that based in the forecasts.

Donna Trumply an investor has approximately one million dollars to invest. 3 Typical Ways to Payoff Your Debt. Get rates for your unique scenario.

The answer is B. The private lender will pay off your original loans and. Chat to us or browse help topics and.

Affordable Essay Writing Service. It was grueling trying to figure out which scenario is best. New construction being financed through the SFHGLP for either construction financing or.

The answer can depend on several things including. Youre 2 minutes away from getting the best mortgage rates in Canada Answer a few quick questions to get a personalized rate quote. 760 Served in the US.

ANSWER Refinance 3555101d3C HB 62 D a1and2 B. Donna calls real estate broker Ben to discuss the. Mortgage rates are totally personal.

You Need To Enable Javascript To Run This App Businesspersonal Savings Investments Home Loans Wealth Management About Us Contact Us Log In Become A Client Home Loans 15 04 2021 Why You Should Consider Refinancing Your Home Loan Alison

Best Refinance Mortgage Companies 2021 The Simple Dollar Refinance Mortgage Mortgage Companies Refinancing Mortgage

:max_bytes(150000):strip_icc()/shutterstock_543954217-5bfc477d46e0fb0051823e47.jpg)

Should You Refinance Your Mortgage When Interest Rates Rise

Best Scenario For Refinancing Framework At Best

When Is Refinancing Worth It Ally

Is Refinancing A Bad Idea Assurance Financial

Is Refinancing A Bad Idea Assurance Financial

Why Would Anyone Refinance A Mortgage After Making The First 6 Payments On Time Quora

A Few Essential Facts Relating To Va Loan Refinancing Va Loan Loan Facts

The Modernization And Development Of Delhi As A Prime Metro City Has Exclusively Contributed To The Increasing Real Estate Real Estate Sales Online Real Estate

Solved Question 3 Of 10 Choose The Best Scenario For Chegg Com

Cmis 141 Quiz 1 Answers Introductory Programming Quiz Application Programming Interface Answers

9 Answers To Your Burning Mortgage Questions Forbes Advisor

Solved 12 16 O B Olte Becoming A Homeowner Question 1 Of 10 Chegg Com

Best Scenario For Refinancing Framework At Best

Choose The Best Scenario For Refinancing Quizlet At Best